Pettis County Property Tax Rate . pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: missouri state auditor's office. taxes are due on december 31 on property owned on assessment date, i.e. the pettis county collector’s office provides taxpayers the option of paying taxes online in the office, or by phone. Stay up to date and subscribe to our report alerts from the state of. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. the assessor is the county official charged with determining the market value and classification of property for tax purposes. A person moves into missouri on march 1, 2024.

from pollyannawselma.pages.dev

Stay up to date and subscribe to our report alerts from the state of. taxes are due on december 31 on property owned on assessment date, i.e. pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: missouri state auditor's office. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. the pettis county collector’s office provides taxpayers the option of paying taxes online in the office, or by phone. A person moves into missouri on march 1, 2024. the assessor is the county official charged with determining the market value and classification of property for tax purposes.

Dallas County Property Tax Rate 2024 Juana Marabel

Pettis County Property Tax Rate the pettis county collector’s office provides taxpayers the option of paying taxes online in the office, or by phone. missouri state auditor's office. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. taxes are due on december 31 on property owned on assessment date, i.e. Stay up to date and subscribe to our report alerts from the state of. the pettis county collector’s office provides taxpayers the option of paying taxes online in the office, or by phone. the assessor is the county official charged with determining the market value and classification of property for tax purposes. pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: A person moves into missouri on march 1, 2024.

From austonmoving.com

Greenville County Property Tax 💰 [2024] Greenville SC Tax Rate Pettis County Property Tax Rate the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. missouri state auditor's office. the assessor is the county official charged with determining the market value and classification of property for tax purposes. pettis county assessor 415 south ohio ave courthouse 2nd. Pettis County Property Tax Rate.

From gretnaqcorinna.pages.dev

Nc Property Tax Rates By County 2024 Lorna Rebecca Pettis County Property Tax Rate the assessor is the county official charged with determining the market value and classification of property for tax purposes. missouri state auditor's office. taxes are due on december 31 on property owned on assessment date, i.e. Stay up to date and subscribe to our report alerts from the state of. the pettis county collector’s office provides. Pettis County Property Tax Rate.

From arielqgianina.pages.dev

Nj Property Tax Rates By Town 2024 Dianne Kerrie Pettis County Property Tax Rate Stay up to date and subscribe to our report alerts from the state of. the assessor is the county official charged with determining the market value and classification of property for tax purposes. taxes are due on december 31 on property owned on assessment date, i.e. A person moves into missouri on march 1, 2024. missouri state. Pettis County Property Tax Rate.

From dxoxmzjlc.blob.core.windows.net

Fulton County Ga Property Tax Look Up at Silvia Pettis blog Pettis County Property Tax Rate Stay up to date and subscribe to our report alerts from the state of. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: A person moves into. Pettis County Property Tax Rate.

From rosemariawlorri.pages.dev

Will County Property Tax Rate 2024 Vivia Joceline Pettis County Property Tax Rate missouri state auditor's office. the pettis county collector’s office provides taxpayers the option of paying taxes online in the office, or by phone. pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: taxes are due on december 31 on property owned on assessment date, i.e. the median property. Pettis County Property Tax Rate.

From www.icsl.edu.gr

How To Calculate Property Tax In Texas Pettis County Property Tax Rate the assessor is the county official charged with determining the market value and classification of property for tax purposes. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. Stay up to date and subscribe to our report alerts from the state of. . Pettis County Property Tax Rate.

From 6thmanmovers.com

Davidson County Property Tax & Nashville Property Tax [2024] 💰 Pettis County Property Tax Rate taxes are due on december 31 on property owned on assessment date, i.e. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. missouri state auditor's office. A person moves into missouri on march 1, 2024. the pettis county collector’s office provides. Pettis County Property Tax Rate.

From activerain.com

2017 Property Tax Rates For Charlotte & Union County,NC Pettis County Property Tax Rate taxes are due on december 31 on property owned on assessment date, i.e. Stay up to date and subscribe to our report alerts from the state of. the assessor is the county official charged with determining the market value and classification of property for tax purposes. the pettis county collector’s office provides taxpayers the option of paying. Pettis County Property Tax Rate.

From dxouazrnh.blob.core.windows.net

Clinton County Real Estate Tax Lookup at Eleanore Davis blog Pettis County Property Tax Rate pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: missouri state auditor's office. A person moves into missouri on march 1, 2024. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. taxes are due. Pettis County Property Tax Rate.

From taxfoundation.org

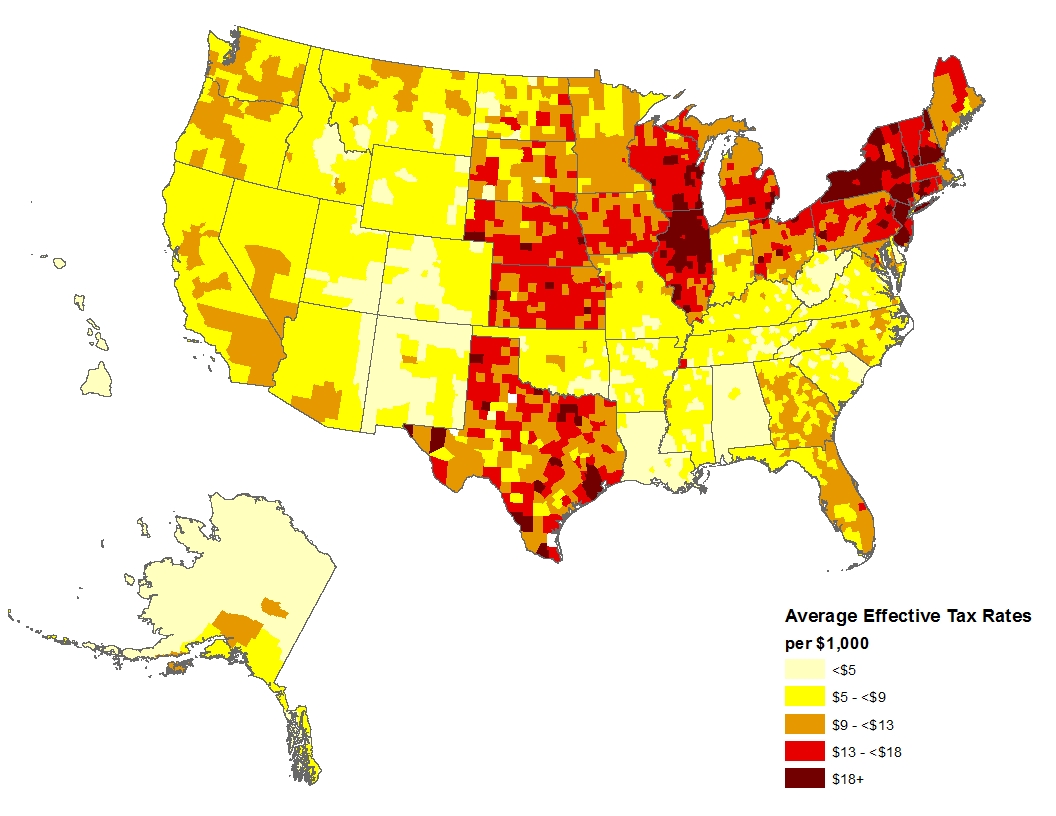

How High Are Property Tax Collections Where You Live? Tax Foundation Pettis County Property Tax Rate taxes are due on december 31 on property owned on assessment date, i.e. the assessor is the county official charged with determining the market value and classification of property for tax purposes. pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: the pettis county collector’s office provides taxpayers the. Pettis County Property Tax Rate.

From dxoddjrhi.blob.core.windows.net

Property Tax Rate In Nc By County at Danny Garcia blog Pettis County Property Tax Rate Stay up to date and subscribe to our report alerts from the state of. missouri state auditor's office. A person moves into missouri on march 1, 2024. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. the assessor is the county official. Pettis County Property Tax Rate.

From natassiawdanila.pages.dev

Fairfax County Property Tax Rate 2024 Amye Madlen Pettis County Property Tax Rate missouri state auditor's office. A person moves into missouri on march 1, 2024. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. the pettis county collector’s office provides taxpayers the option of paying taxes online in the office, or by phone. . Pettis County Property Tax Rate.

From www.mapsales.com

Pettis County, MO Wall Map Premium Style by MarketMAPS Pettis County Property Tax Rate the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. A person moves into missouri on march 1, 2024. the assessor is the county official charged with determining the market value and classification of property for tax purposes. taxes are due on december. Pettis County Property Tax Rate.

From cenlzzgl.blob.core.windows.net

Maryland County Property Tax Rates 2020 at Randolph Sheaffer blog Pettis County Property Tax Rate pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: taxes are due on december 31 on property owned on assessment date, i.e. Stay up to date and subscribe to our report alerts from the state of. the assessor is the county official charged with determining the market value and classification. Pettis County Property Tax Rate.

From classcampusenrique.z19.web.core.windows.net

Information On Property Taxes Pettis County Property Tax Rate Stay up to date and subscribe to our report alerts from the state of. pettis county assessor 415 south ohio ave courthouse 2nd floor, suite 218 sedalia, mo 65301 voice: missouri state auditor's office. A person moves into missouri on march 1, 2024. the pettis county collector’s office provides taxpayers the option of paying taxes online in. Pettis County Property Tax Rate.

From dxoxmzjlc.blob.core.windows.net

Fulton County Ga Property Tax Look Up at Silvia Pettis blog Pettis County Property Tax Rate missouri state auditor's office. the assessor is the county official charged with determining the market value and classification of property for tax purposes. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. A person moves into missouri on march 1, 2024. . Pettis County Property Tax Rate.

From natassiawdanila.pages.dev

Fairfax County Property Tax Rate 2024 Amye Madlen Pettis County Property Tax Rate taxes are due on december 31 on property owned on assessment date, i.e. Stay up to date and subscribe to our report alerts from the state of. the assessor is the county official charged with determining the market value and classification of property for tax purposes. the median property tax (also known as real estate tax) in. Pettis County Property Tax Rate.

From wallethub.com

Property Taxes by State Pettis County Property Tax Rate taxes are due on december 31 on property owned on assessment date, i.e. the median property tax (also known as real estate tax) in pettis county is $803.00 per year, based on a median home value of. the pettis county collector’s office provides taxpayers the option of paying taxes online in the office, or by phone. . Pettis County Property Tax Rate.